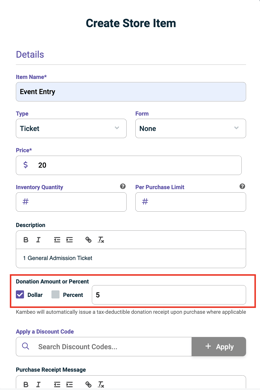

Donation Amount as Portion of Ticket Sale

Event organizers can set a donation amount as a portion of the ticket price.

How it works

Let's use an example. A Ticket Price is $20 and the donation portion is set at $5.

When someone purchases the ticket they will receive a receipt for $20 that will indicate $5 was a donation.

If the event organizer is a charity and has automated charitable tax receipting is turned on, the ticket purchaser will also receive a charitable tax receipt email.

If automated charitable tax receipting is off, event organizers can send the receipts manually in the Event transactions tab.

Why use this feature?

1. For charities: Encourage more purchasers by providing ticket purchasers with a tax-deductible incentive.

2. To use the fundraising progress bar for ticket sales. Learn more about the progress bar here.